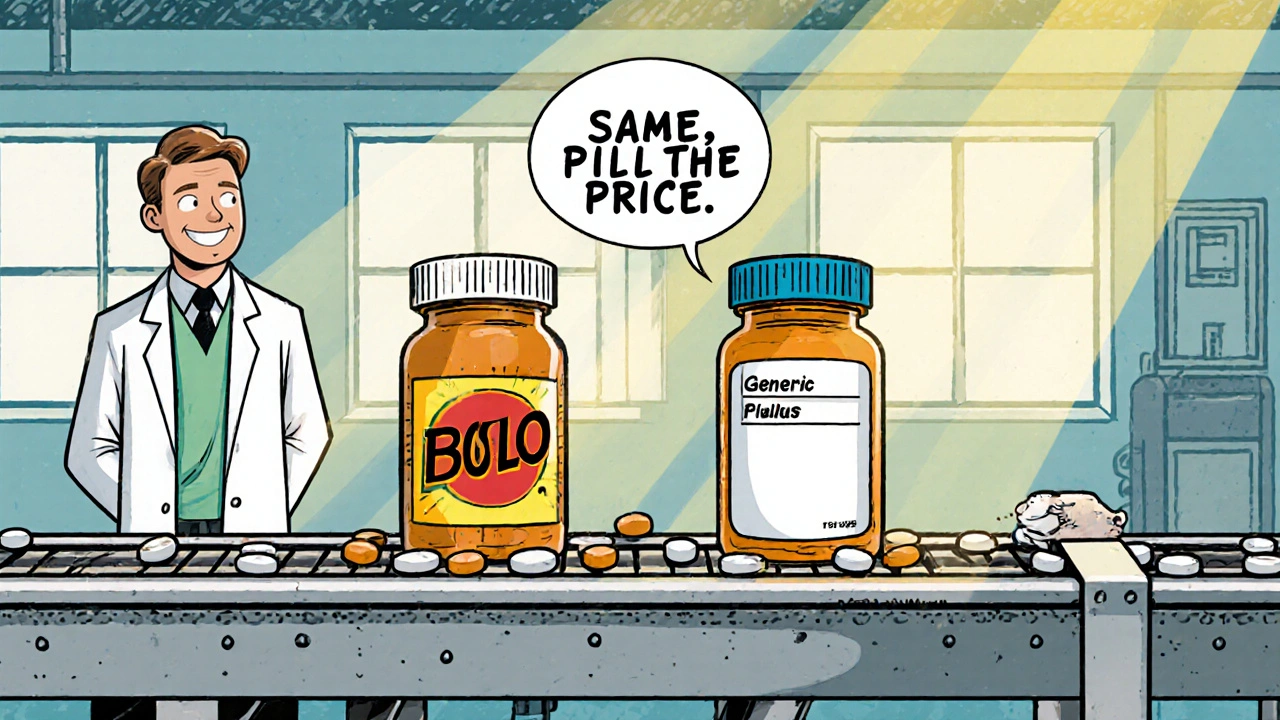

When a blockbuster drug loses its patent, the brand company doesn’t just sit back and watch its sales vanish. Instead, many of them launch something called an authorized generic-a version of their own drug sold under a generic label, at generic prices, but made by the same company that made the brand version. It sounds strange at first: why would a company undercut its own product? The answer isn’t about charity. It’s about survival.

What Exactly Is an Authorized Generic?

An authorized generic is identical to the brand-name drug you’ve been taking. Same active ingredient. Same inactive ingredients. Same pills, same capsules, same coating. The only differences? No brand name on the bottle, and usually a different color or marking. It’s not a copy. It’s the real thing, just sold without the marketing. Unlike traditional generics, which go through the FDA’s Abbreviated New Drug Application (ANDA) process and can have different fillers or binders, authorized generics skip that entirely. They’re made under the original brand’s New Drug Application (NDA). That means the FDA already approved the exact formula years ago. No new testing. No delays. The brand company just starts selling it under a different label. For example, when Pfizer launched the authorized generic of Celebrex (celecoxib), it was the same pill patients had been taking for years-just without the blue logo. Same manufacturer. Same factory. Same quality control. The only change? The price dropped by 60-80%.Why Do Brand Companies Do This?

The main reason? To keep money coming in after the patent expires. When a drug’s patent runs out, generic manufacturers rush in. In many cases, the brand loses 80-90% of its sales within the first year. That’s a massive revenue drop. But if the brand company launches its own authorized generic, it doesn’t lose everything. It keeps a slice of the market. Think of it like this: you own a popular coffee shop. When a new competitor opens across the street, you could either shut down or open a cheaper version of your own shop under a different name. That’s what authorized generics are. The brand keeps its premium store (the original drug) for customers who don’t mind paying more, and opens a budget version (the authorized generic) to grab price-sensitive buyers. This isn’t just theory. Between 2010 and 2019, over 850 authorized generics hit the U.S. market. And in markets where the first generic company had 180 days of exclusivity under the Hatch-Waxman Act, about 70% of authorized generics launched before or during that window. Why? To cut off that generic company’s chance to charge monopoly prices.The Hatch-Waxman Act and the 180-Day Advantage

The Hatch-Waxman Act of 1984 gave the first generic company to file an application a 180-day window where no other generic could enter the market. That meant that single generic could charge high prices, often 2-3 times the cost of later generics. But if the brand company launches an authorized generic during that 180-day window? Suddenly, there are two versions of the same drug on the shelf. The first generic can’t charge premium prices anymore. Prices drop fast. The Federal Trade Commission found this in 2011: when authorized generics entered during the exclusivity period, prices were significantly lower than in markets without them. That’s not a coincidence. It’s strategy. Brand companies use authorized generics as a weapon. They don’t just wait for competition-they jump in first and make sure the first generic doesn’t get rich off their own invention.

Who Buys Authorized Generics?

Patients do. And they prefer them. A 2005 study by Roper Public Affairs found that over 80% of Americans wanted the option to get an authorized generic. Why? Because they know it’s the exact same drug. No guesswork. No worry that the generic might not work the same way. That’s especially important for drugs with narrow therapeutic windows-medications where tiny differences in dosage or formulation can cause serious side effects. Think thyroid meds, seizure drugs, or blood thinners. Patients and doctors trust the exact same formula. An authorized generic gives them that peace of mind at a lower price. Even pharmacies like CVS and Walgreens often stock authorized generics because they’re more reliable than traditional generics. Pharmacists know the supply chain is the same. No surprises.How It Helps the Brand Company Financially

Let’s say a drug brings in $1 billion a year in sales. When the patent expires, the brand might lose 85% of that-down to $150 million. But if the company launches an authorized generic and captures 20% of the generic market, it could keep $100-$150 million in revenue. That’s not a small win. That’s keeping half of what it lost. And it’s not just about sales. It’s about infrastructure. Brand companies spent millions building manufacturing plants, quality labs, and distribution networks. If they shut it all down after patent expiry, they lose that investment. With an authorized generic, they keep those factories running. They keep skilled workers employed. They avoid massive layoffs. Companies like Greenstone Pharmaceuticals (a Pfizer subsidiary) and Amneal now make entire business lines out of authorized generics. They don’t just sell them-they manage them like core products.

How the Strategy Is Evolving

In the past, brand companies waited until after a generic competitor showed up. Now, they’re acting earlier. Recent data from 2020-2023 shows brand companies are launching authorized generics even before the first generic files its application. It’s a preemptive strike. They’re saying: “We’re going to flood the market with our version before you even get started.” Some are even using distribution tricks. They sell the authorized generic only through mail-order pharmacies or specific retail chains. That way, it doesn’t show up next to the brand drug on the shelf. No direct price comparison. Patients still get the same drug, but the brand keeps its premium pricing intact. This isn’t just about protecting revenue anymore. It’s about controlling the entire market.What’s Next? Authorized Biosimilars

The same strategy is now being tested with biologics-complex drugs made from living cells, like Humira or Enbrel. These drugs are expensive, often over $100,000 a year. Their patents are expiring now, and biosimilars (similar, not identical, versions) are starting to appear. Brand companies are already testing “authorized biosimilars.” They’re making their own version of the biosimilar and selling it under a generic label. The FDA hasn’t officially defined this yet, but the pattern is clear: if it worked for pills, it’ll work for injections. The FTC is watching closely. While authorized generics have lowered prices and helped consumers, regulators are still asking: is this fair? Is it anti-competitive? The answer so far? Yes, it lowers prices. Yes, it helps patients. And yes, it’s legal.Bottom Line: It’s Not About Cheating. It’s About Control.

Brand companies don’t launch authorized generics because they’re nice. They do it because they have to. The pharmaceutical market is brutal. Once a patent expires, the game changes. If you don’t adapt, you die. Authorized generics let them stay in the game. They keep revenue flowing. They keep patients loyal. They keep factories open. And they make sure the first generic company doesn’t walk away with all the profit. For patients? It’s a win. Same drug. Lower price. More options. For the brand? It’s not a loss. It’s a smart pivot.Are authorized generics the same as the brand drug?

Yes. Authorized generics contain the exact same active and inactive ingredients as the brand-name drug. They’re made in the same factory, using the same process. The only differences are the packaging and label. They’re not copies-they’re the original product sold under a generic name.

Why are authorized generics cheaper than the brand?

They’re cheaper because they don’t carry the marketing, advertising, and brand premium costs. The brand company stops spending on commercials, patient support programs, and doctor promotions. The drug itself hasn’t changed-only the pricing model. This lets the company offer it at generic prices while still making a profit.

Do authorized generics get approved by the FDA?

They don’t need a separate FDA approval. Since they’re made under the original brand’s New Drug Application (NDA), the FDA already approved the formula years ago. The brand company just notifies the FDA that it’s launching a generic version. That’s why authorized generics can hit the market faster than traditional generics.

Can I trust an authorized generic as much as the brand?

Absolutely. Because it’s the same drug, made by the same company, in the same facility, with the same quality controls. Many doctors actually prefer authorized generics for drugs with narrow therapeutic windows-like warfarin or levothyroxine-because there’s zero risk of formulation differences affecting how the drug works.

Do insurance plans cover authorized generics?

Yes. Most insurance plans treat authorized generics the same as traditional generics. They’re often placed in the lowest cost tier, meaning you pay the least out-of-pocket. Some plans even encourage them because they save money for the insurer-and for you.

Why don’t all brand companies launch authorized generics?

Not every company has the manufacturing capacity or the business model to do it. Some prefer to exit the market entirely after patent loss. Others may not see enough profit potential in the generic segment. But for big brands with high-volume drugs and existing production lines, it’s one of the smartest moves they can make.

All Comments

Malia Blom November 9, 2025

So let me get this straight - the pharma giants are basically playing chess while the rest of us are stuck with checkers. They don’t just wait for generics to kill them - they invent a fake generic to murder the real one before it even wakes up. Genius? Or just monstrous? I mean, they’re not cheating the system - they’re the system. And we’re just the dumbasses buying the same pill with a different label and calling it a ‘win.’ 🤡

Erika Puhan November 10, 2025

From a regulatory arbitrage standpoint, the authorized generic paradigm represents a suboptimal equilibrium in the post-patent pharmacoeconomic landscape. The NDA-based replication circumvents ANDA entry barriers, effectively internalizing competitive displacement while externalizing consumer welfare gains. This is not innovation - it’s institutionalized rent-seeking disguised as market efficiency.

Edward Weaver November 11, 2025

Let’s be real - America invented this system. We fund the R&D, we pay the prices, and then we act shocked when Big Pharma doesn’t just roll over and die when the patent expires. Other countries get cheap generics. We get authorized generics - and we should be grateful. If you want cheaper drugs, stop complaining and start making them yourself. Or move to India. 🇺🇸💪

Lexi Brinkley November 12, 2025

Same pill. Half the price. No drama. 😍 I’ve been switching to authorized generics for years - my insurance loves it, my doctor doesn’t care, and my wallet is crying happy tears. Why is this even a debate? 🙃

Kelsey Veg November 14, 2025

okay but like… why do they even bother with the whole ‘authorized’ thing? just call it the cheap version. and why does the label have to be diffrent? its the same damn pill. smh. i just want my med to not cost 200 bucks

Alex Harrison November 15, 2025

I never thought about this before but it makes sense. I mean, if you spent billions building a factory and training people to make a drug, why shut it all down just because the patent ran out? Keeping it running with a generic label is smarter than laying everyone off. Plus, patients get the same quality - that’s not evil, that’s practical. Just wish more companies did it.

Jay Wallace November 17, 2025

Let’s not sugarcoat this: this is corporate opportunism at its finest. The brand companies didn’t ‘innovate’ - they exploited a loophole in Hatch-Waxman. And now they’re doing it again with biosimilars? The FDA’s asleep at the wheel. This isn’t capitalism - it’s legalized looting. And don’t tell me ‘it’s legal’ - that’s not the point. The point is: who benefits? Not you. Not me. The shareholders.

Alyssa Fisher November 17, 2025

There’s something deeply human about this whole thing. We treat medicine like a product, but for so many people, it’s a lifeline. The fact that a company can take the exact same pill they made for years - the one that kept someone alive - and just slap a new label on it… it’s not just business. It’s a mirror. We’ve built a system where survival depends on who controls the label, not who needs the drug. Maybe we should ask: why does the price have to change at all if the medicine doesn’t? The real innovation would be decoupling cost from ownership.

Alyssa Salazar November 17, 2025

Okay but can we talk about how wild it is that the FDA doesn’t require a new approval for these? Like, the brand company just says, ‘Hey, we’re selling the same thing under a different name’ and boom - it’s on shelves. That’s not transparency, that’s regulatory theater. And don’t get me started on how they use mail-order exclusivity to hide the price gap. It’s not just strategy - it’s psychological manipulation. Patients think they’re choosing a cheaper option, but they’re being herded into a version the brand wants them to buy. I’m not mad - I’m just disappointed.